Onde DEALS ESTRATÉGICOS

acontecem.

De maneira inteligente.

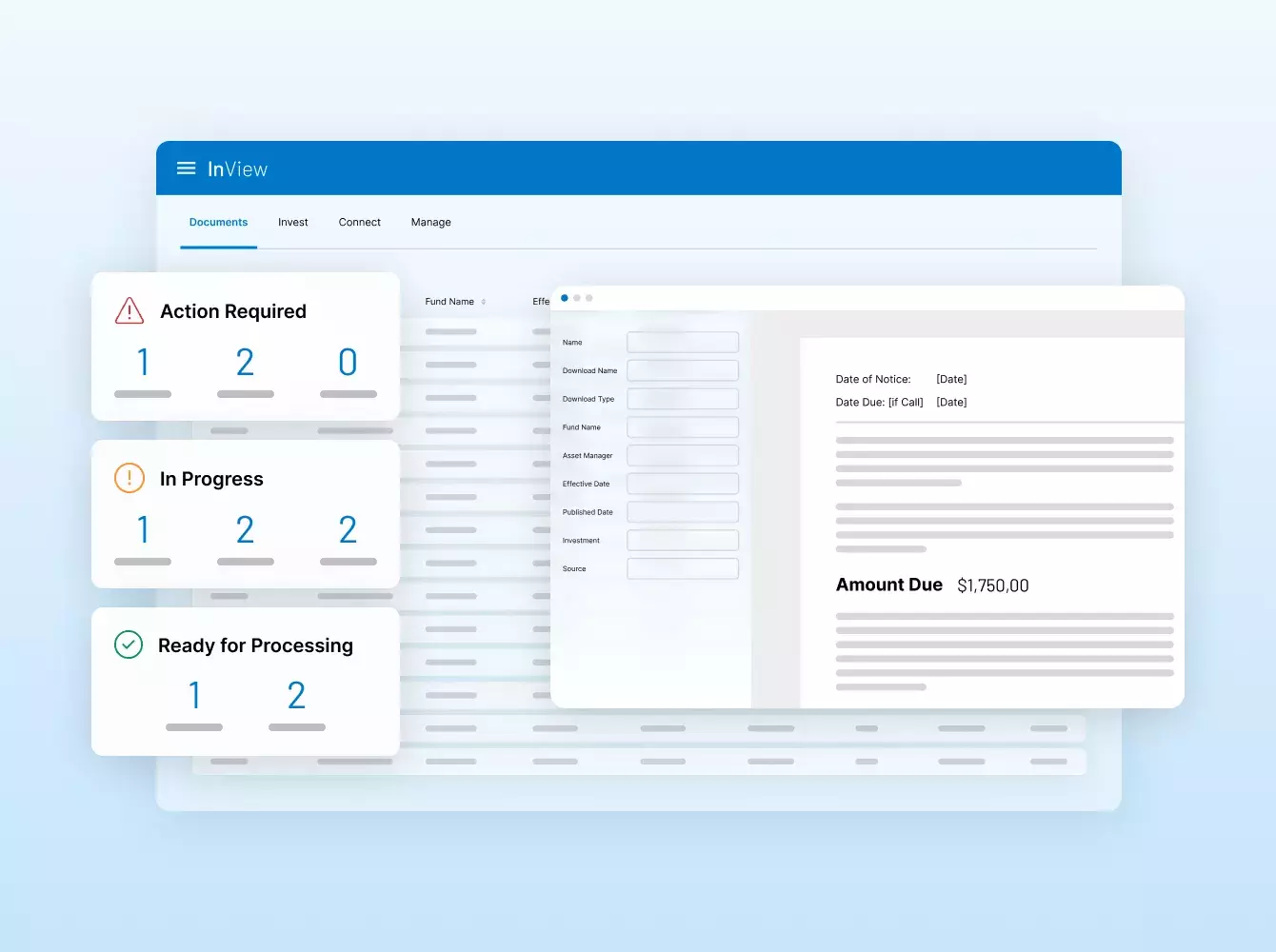

Impulsionando seus deals de maneira robusta, com segurança e eficiência incomparáveis. Soluções em nuvem para as operações de mercado de capitais, empréstimos sindicalizados, captação de fundos, integração de investidores, relatórios financeiros e muito mais.

Reconhecida pela Fortune 500 e pelos maiores formadores de mercado

Raytheon

US$ 89,8 bi

A SS&C Intralinks facilitou a aquisição da Raytheon pela United Technologies por US$ 89,8 bilhões.

Dow

US$ 57,3 bi

A SS&C Intralinks facilitou o spin-off de US$ 57,3 bilhões da Dow Holdings Inc. para os acionistas.

Anaplan

US$ 10,3 bi

A SS&C Intralinks facilitou a aquisição de US$ 10,3 bilhões da Anaplan pela Thoma Bravo.

Whole Foods

US$ 13,6 bi

A SS&C Intralinks facilitou a aquisição do Whole Foods pela Amazon por US$ 13,6 bilhões.

Fortress

US$ 3,3 bi

A SS&C Intralinks facilitou a aquisição de US$ 3,3 bilhões do Fortress Investment Group pelo SoftBank.

TSG Consumer

US$ 6 bi

A SS&C Intralinks facilitou o fundraising do fundo TSG9 do TSG, um fundo de aquisição focado no setor de consumo.

Neuberger Berman

US$ 2,5 bi

A SS&C Intralinks facilitou o fundraising do NB Credit Opportunities Fund II da Neuberger.

Riverside

US$ 1,87 bi

A SS&C Intralinks facilitou o fundraising do Micro-Cap Fund VI da Riverside.

Hayfin

US$ 6,61 bi

A SS&C Intralinks facilitou a fundraising do Direct Lending Fund IV da Hayfin.

Summit Partners

US$ 1,52 bi

A SS&C Intralinks facilitou o fundraising do Europe Growth Equity Fund IV da Summit Partner.

O provedor de tecnologia financeira

mais confiável do mundo.

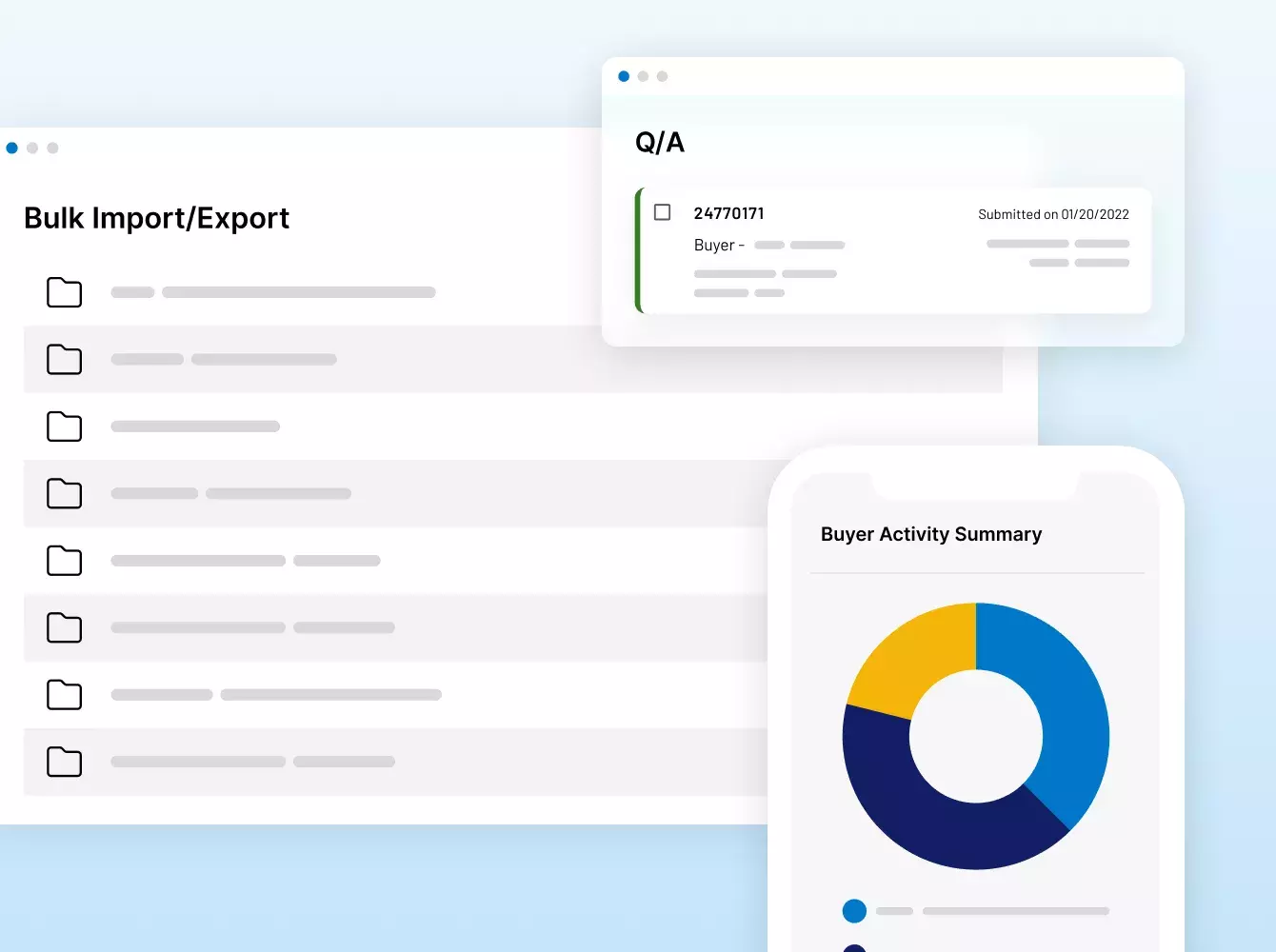

A Intralinks foi pioneira no mercado VDR há mais de 20 anos e continua a inovar desde então. Nossas soluções impulsionam os maiores deals dos mercados de capitais do mundo e permitem que GPs ofereçam experiências de classe mundial para LPs.

ENTRE EM CONTATONº 1 em M&A

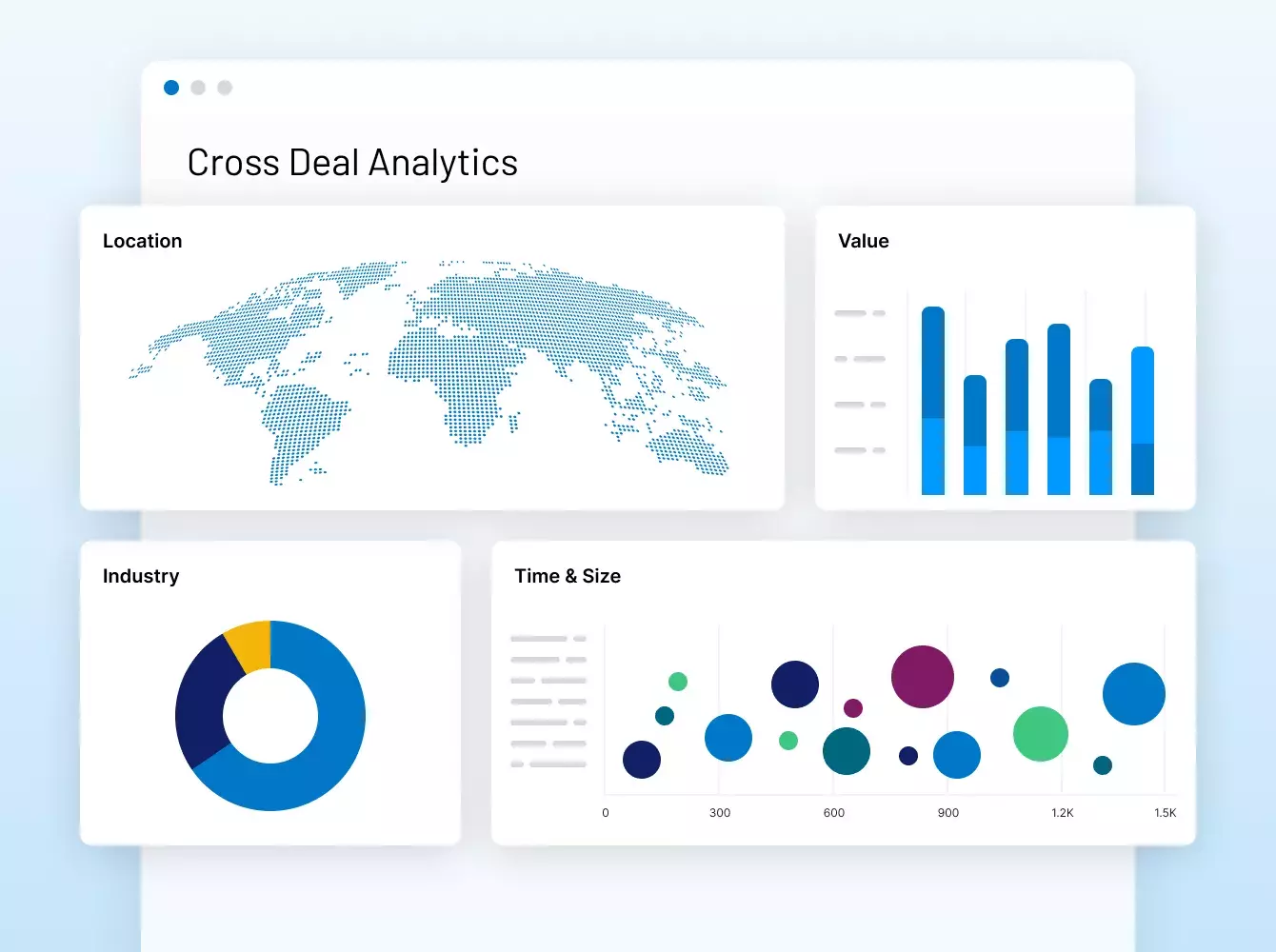

Soluções de deals com mais de US$ 35 trilhões em transações financeiras

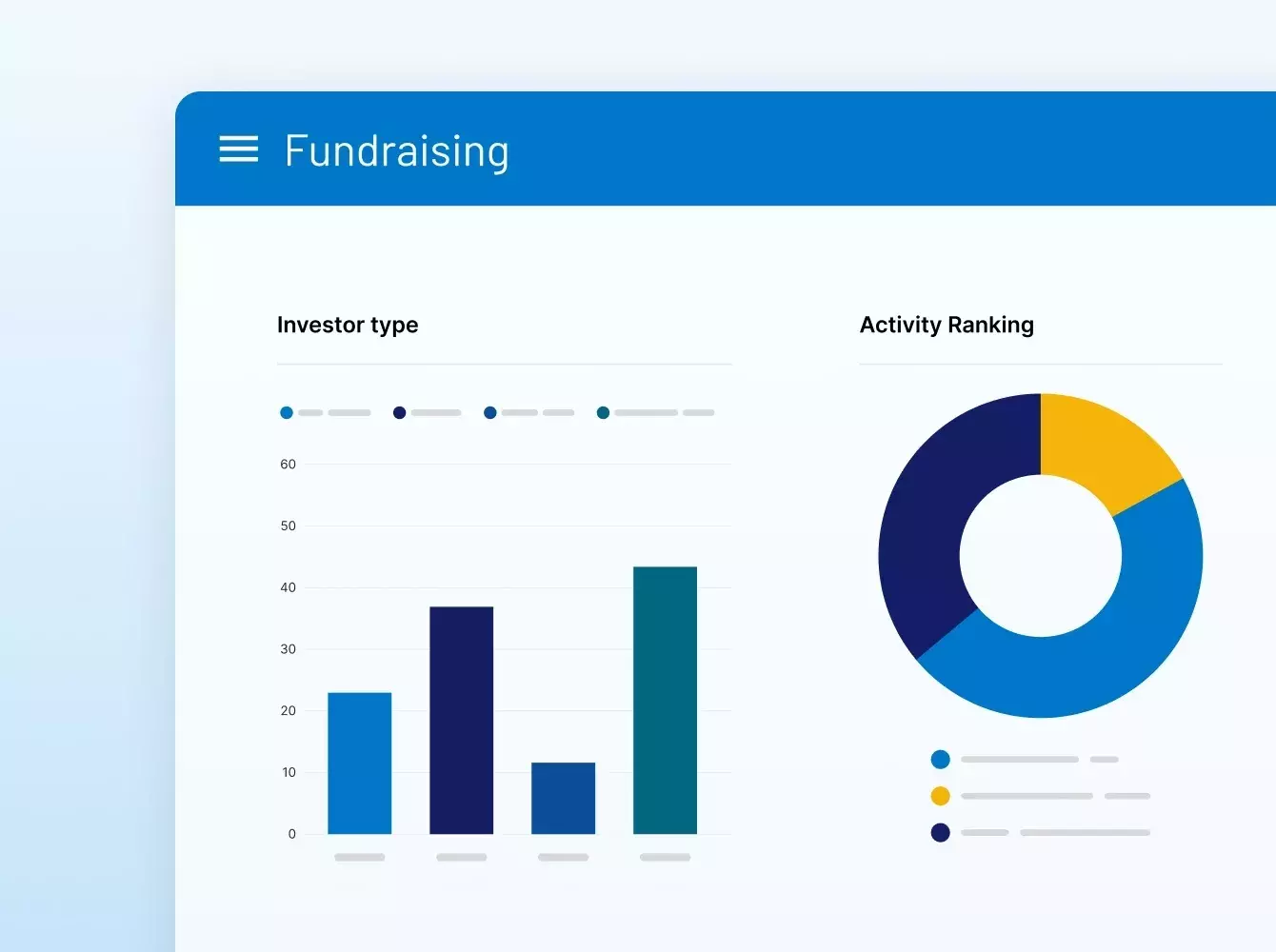

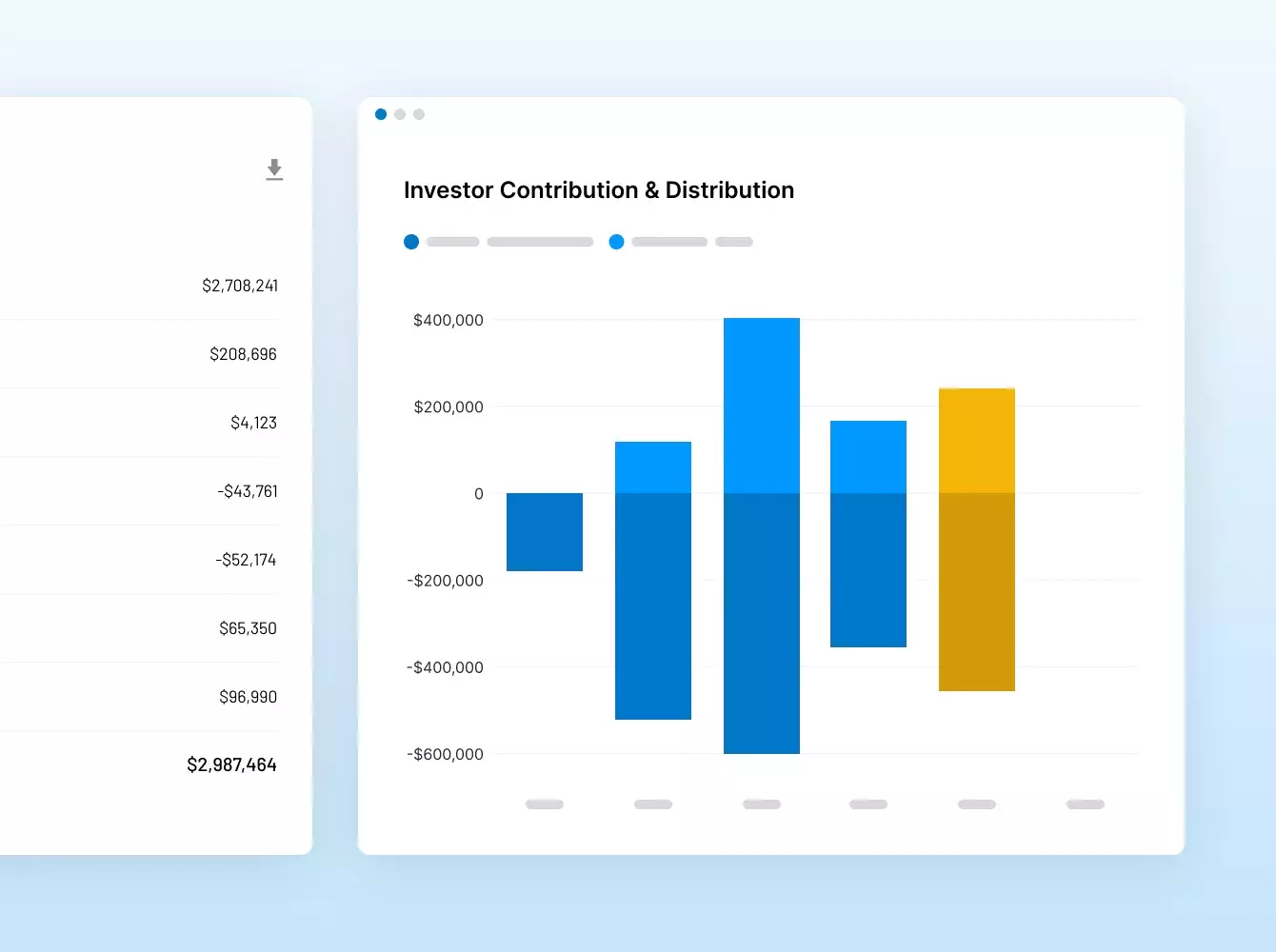

N°1 GP-LP

Comunidade com 515 mil indivíduos de mais de 100 mil organizações

Nº 1

Plataforma de Captação de Fundos

Mais de US$ 1 a cada US$ 2 captados globalmente

+ US$ 200 milhões

Em investimento em R&D nos últimos cinco anos

ISO 27701

Primeiro provedor de VDR a obter a a mais alta certificação de privacidade de dados

6

Tempo médio de apenas alguns segundos para entrar em contato com nossa premiada equipe de suporte

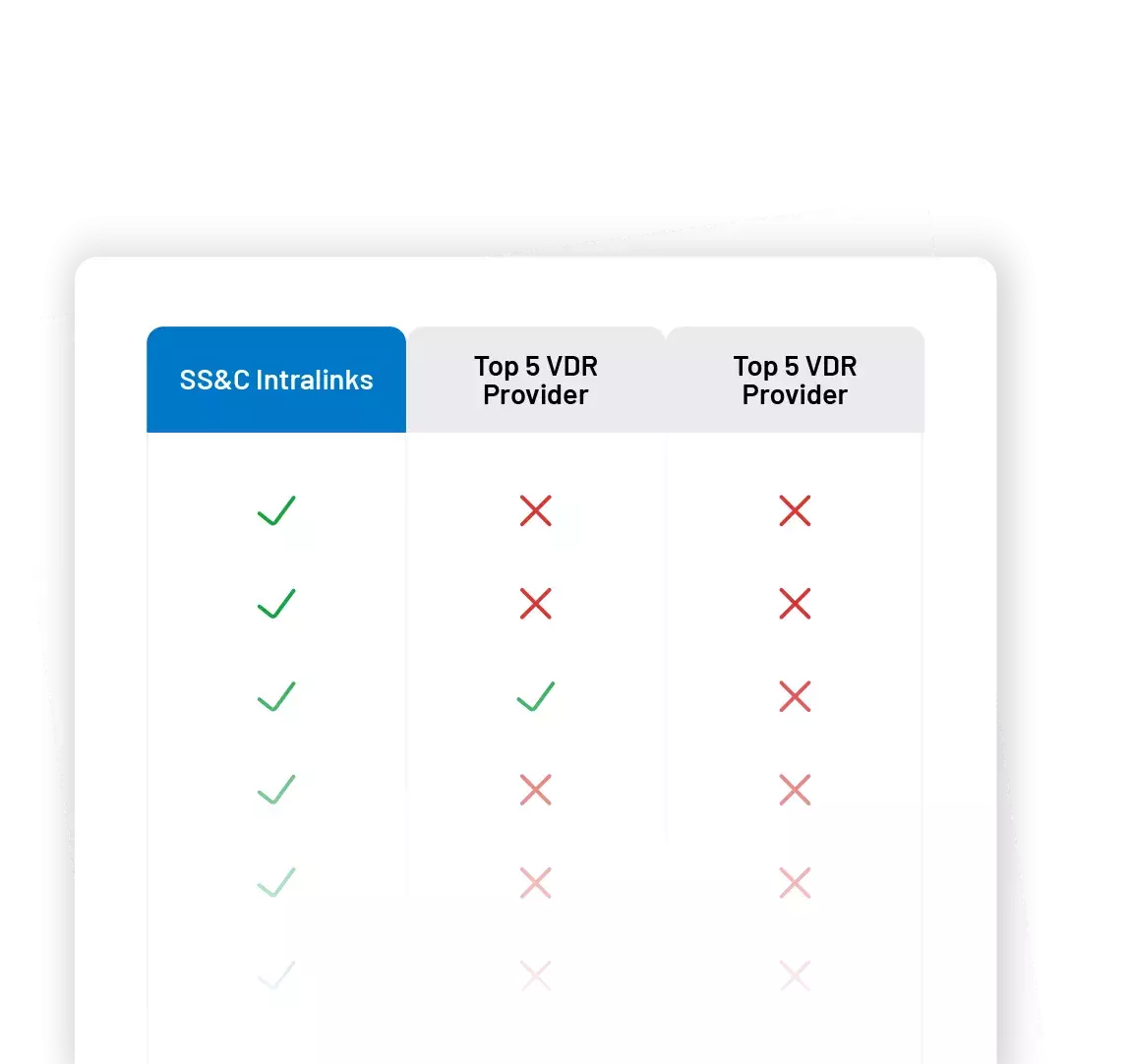

Precisa aconselhar seu cliente

sobre como escolher um VDR?

Assessores muitas vezes precisam apresentar aos seus clientes uma comparação de alternativas de VDR. Para economizar seu tempo, criamos um modelo que inclui uma comparação de recursos entre os principais fornecedores de VDR.

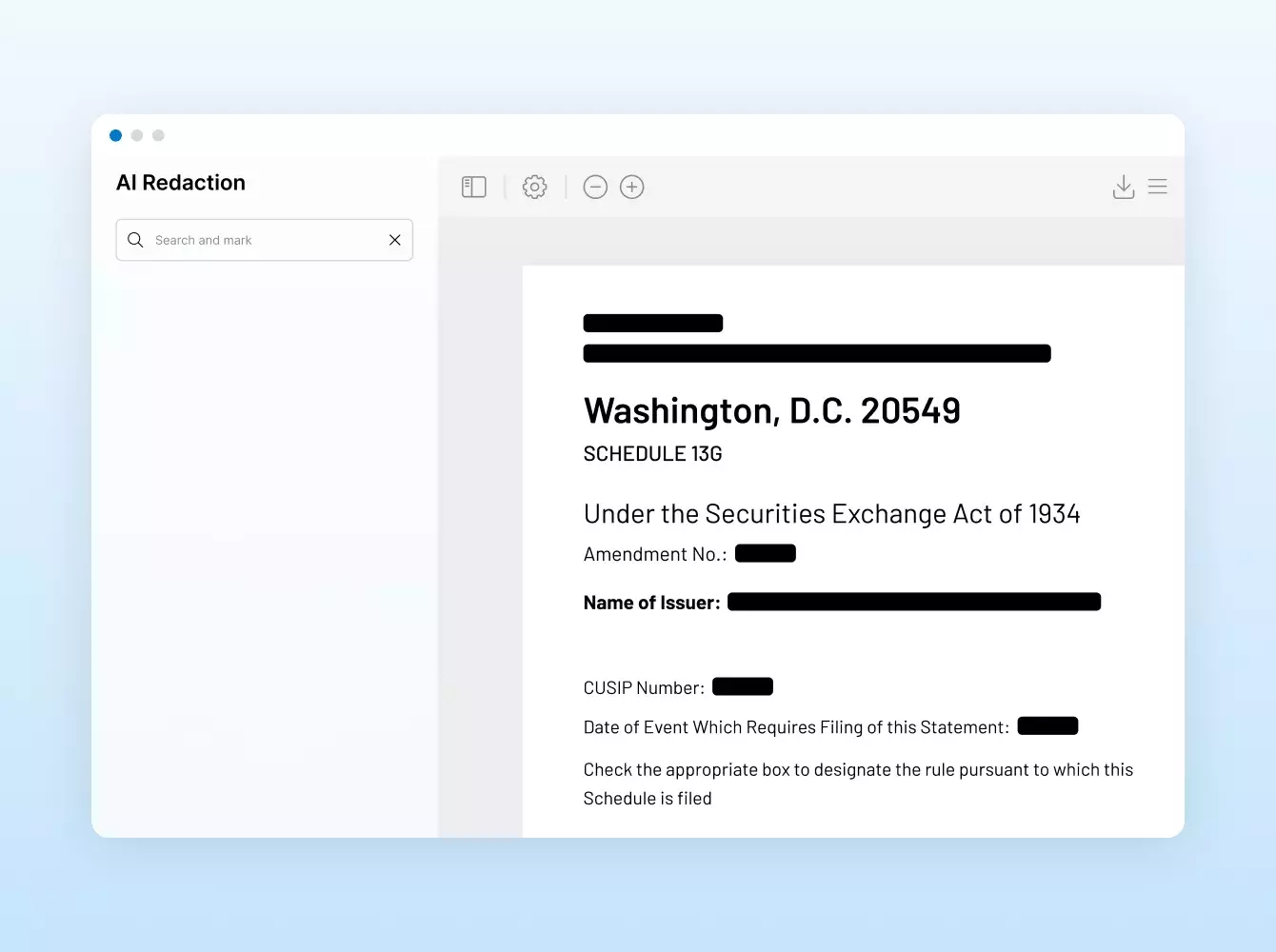

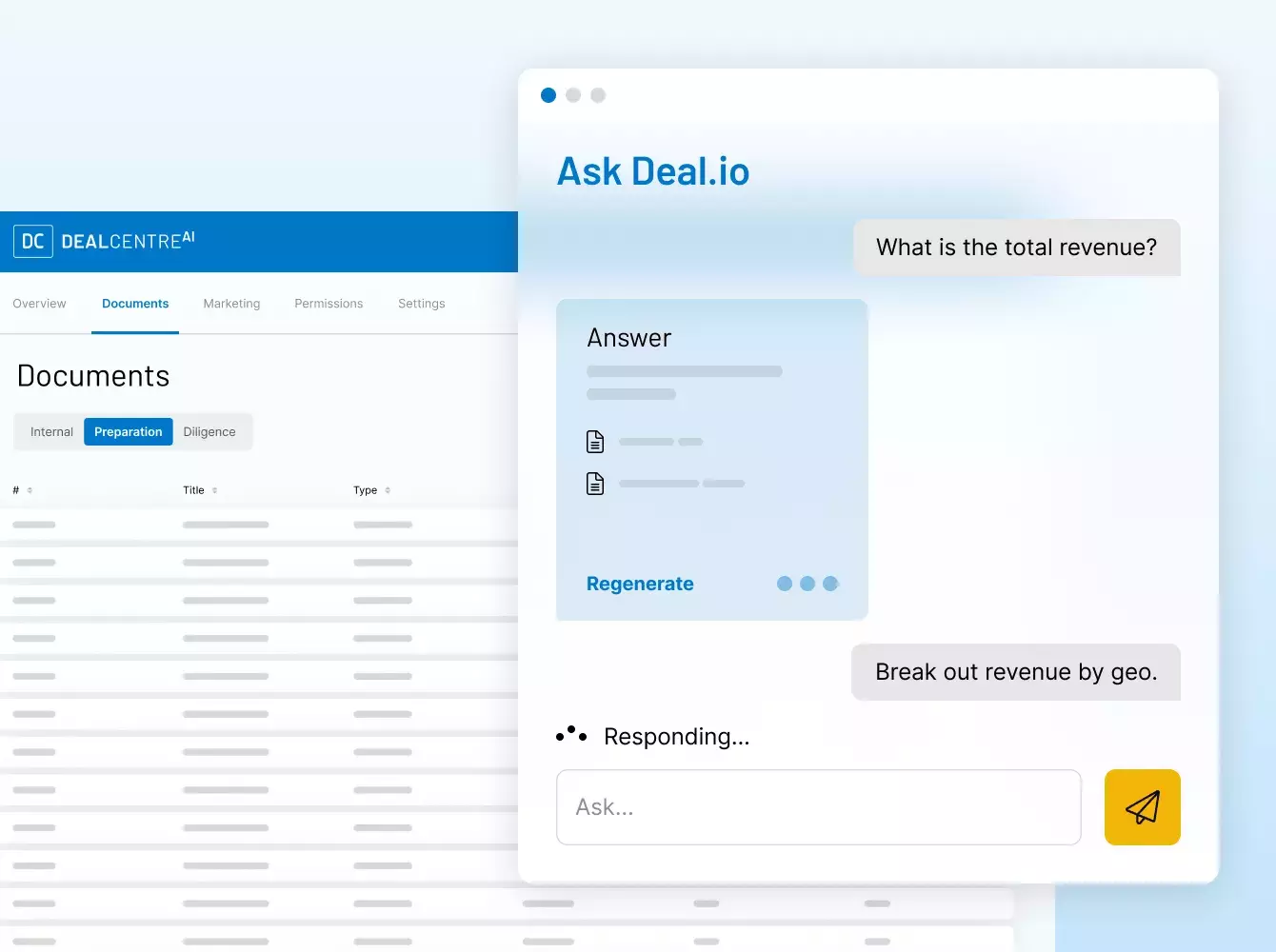

Por que preciso de um lugar seguro para meus dados?

Transações financeiras envolvem inúmeros documentos, e muitos são confidenciais e incluem informações sigilosas. Escolher um provedor comprovadamente confiável é essencial. Na Intralinks, nossa missão é proteger seu deal e seus dados por meio de um ecossistema dedicado à total segurança, para você, seus clientes e seus parceiros.

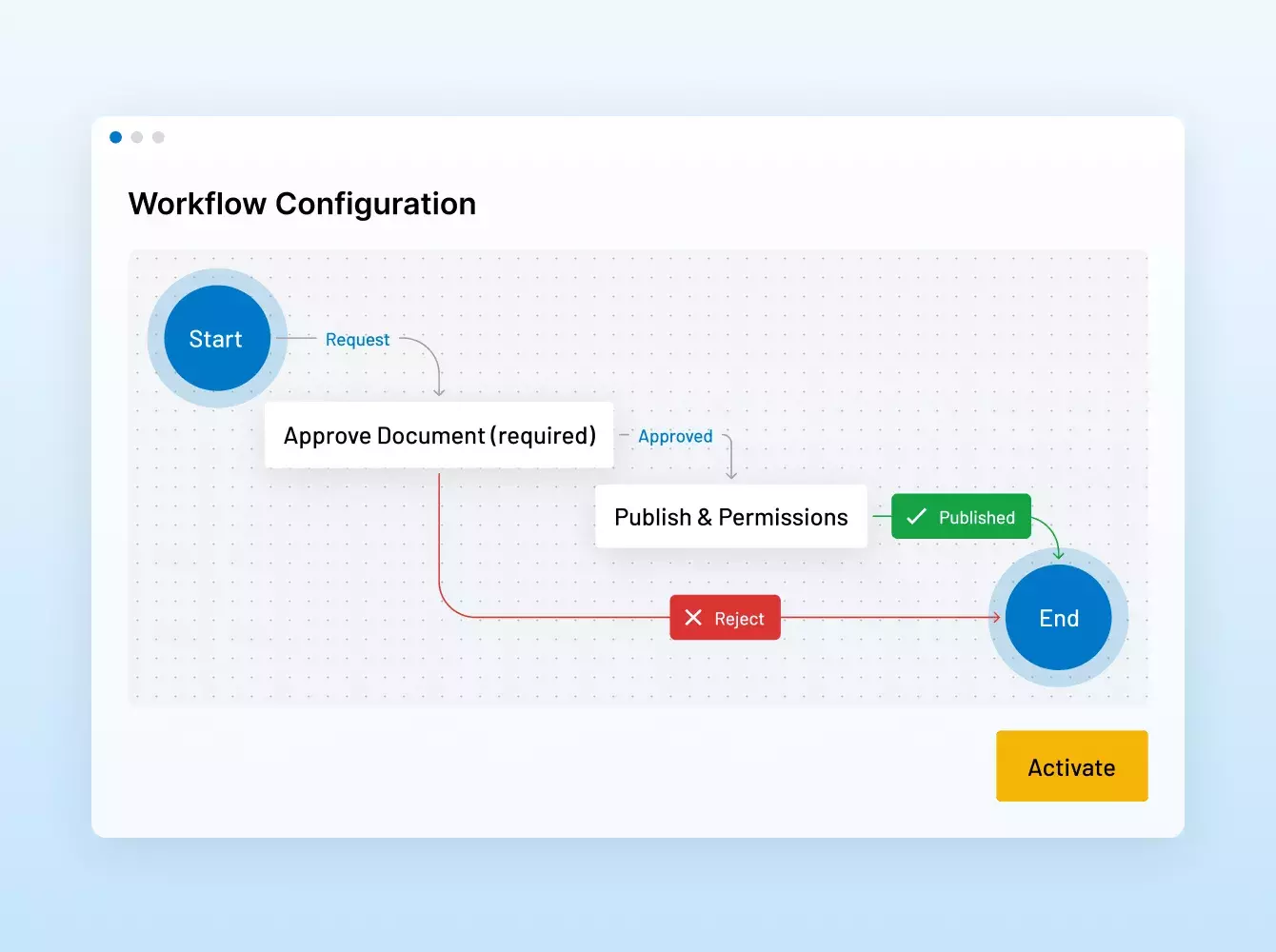

Quais serviços adicionais vocês oferecem?

Seja para assistência tática na configuração de um VDR, recursos extras para tarefas tediosas como revisões ou NDAs, ou uma solução totalmente personalizada com automação e integrações complexas, as equipes de serviços da Intralinks estão prontas para ajudar. Nossa oferta de serviços combina nossa tecnologia pioneira, expertise no setor e décadas de experiência para atender a qualquer necessidade em cada estágio de um deal ou projeto.

Por que vocês são a melhor escolha em relação aos outros provedores?

A Intralinks é pioneira no mercado de Data Room Virtual (VDR), inovando continuamente a maneira como nossos clientes trabalham com soluções desenvolvidas para esse fim e segurança do mais alto nível para proteger dados e reputações. Somos parte da SS&C Technologies, uma empresa de tecnologia financeira de grande porte com mais de US$ 6 bilhões em receita. Enquanto os concorrentes reduzem os investimentos em P&D e serviços, continuamos a investir, alocando mais de US$ 200 milhões ao longo de cinco anos a fim de oferecer uma experiência inovadora aos nossos clientes.

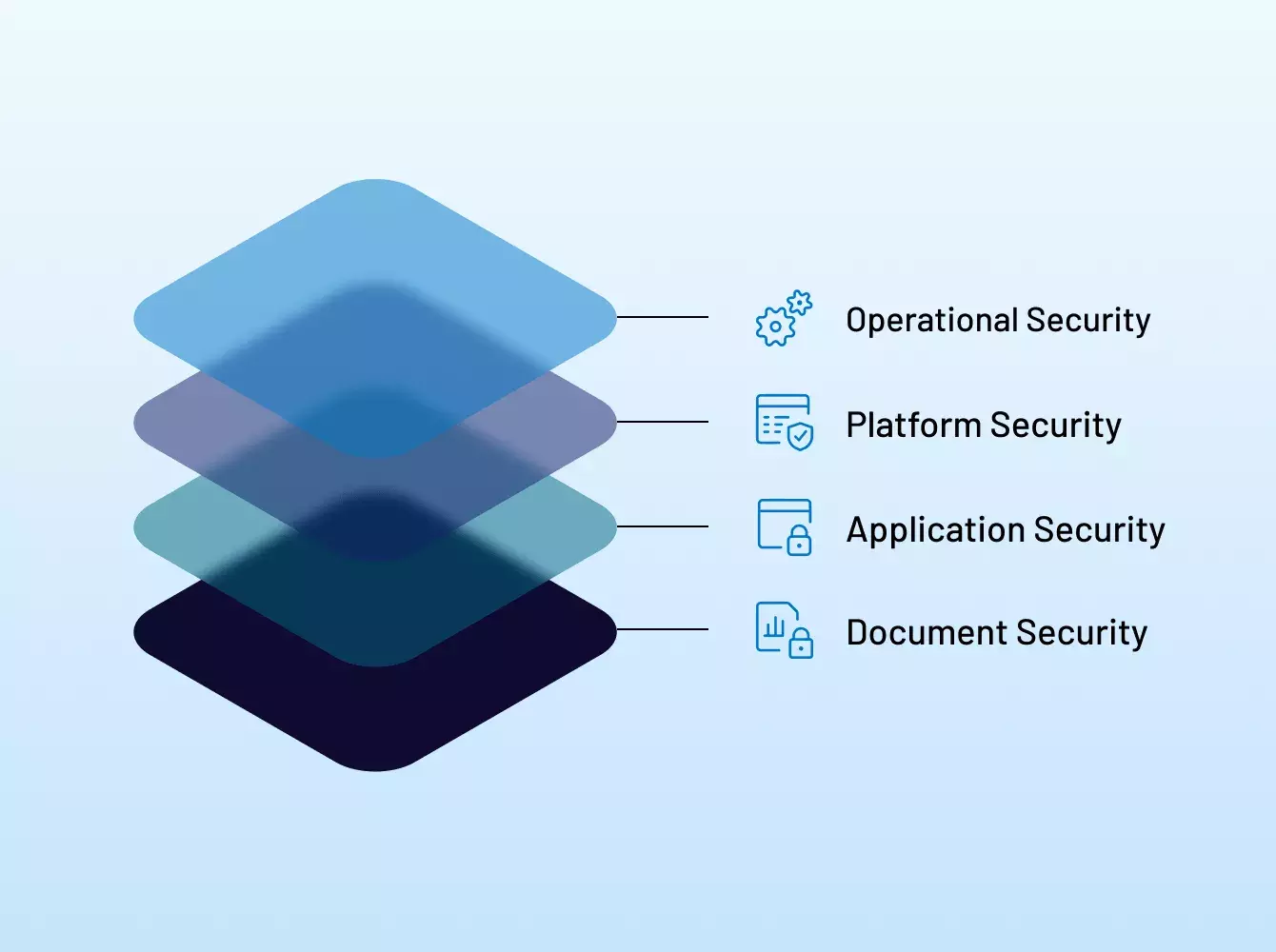

Outras soluções de compartilhamento de arquivos não são igualmente seguras?

Não. Embora outros provedores afirmem ser seguros, muitos usam linguagem deliberadamente vaga e enganosa para mascarar suas verdadeiras credenciais de segurança. Nossa abordagem abrangente de segurança inclui certificações líderes no setor e práticas recomendadas de conformidade que se estendem por todos os aspectos das pessoas, processos, políticas e infraestrutura de suporte da Intralinks.

Últimos INsights

Líder do setor em relacionamento, eventos e recursos.

Siga em frente.

- Segurança líder no setor

- Alcance global e confiabilidade

- Soluções versáteis e fáceis de usar

- Melhor suporte da categoria